San Francisco launches a new $3.6 million Downtown SF Vibrancy Loan & Grant Fund to encourage small businesses to fill vacant storefronts in downtown

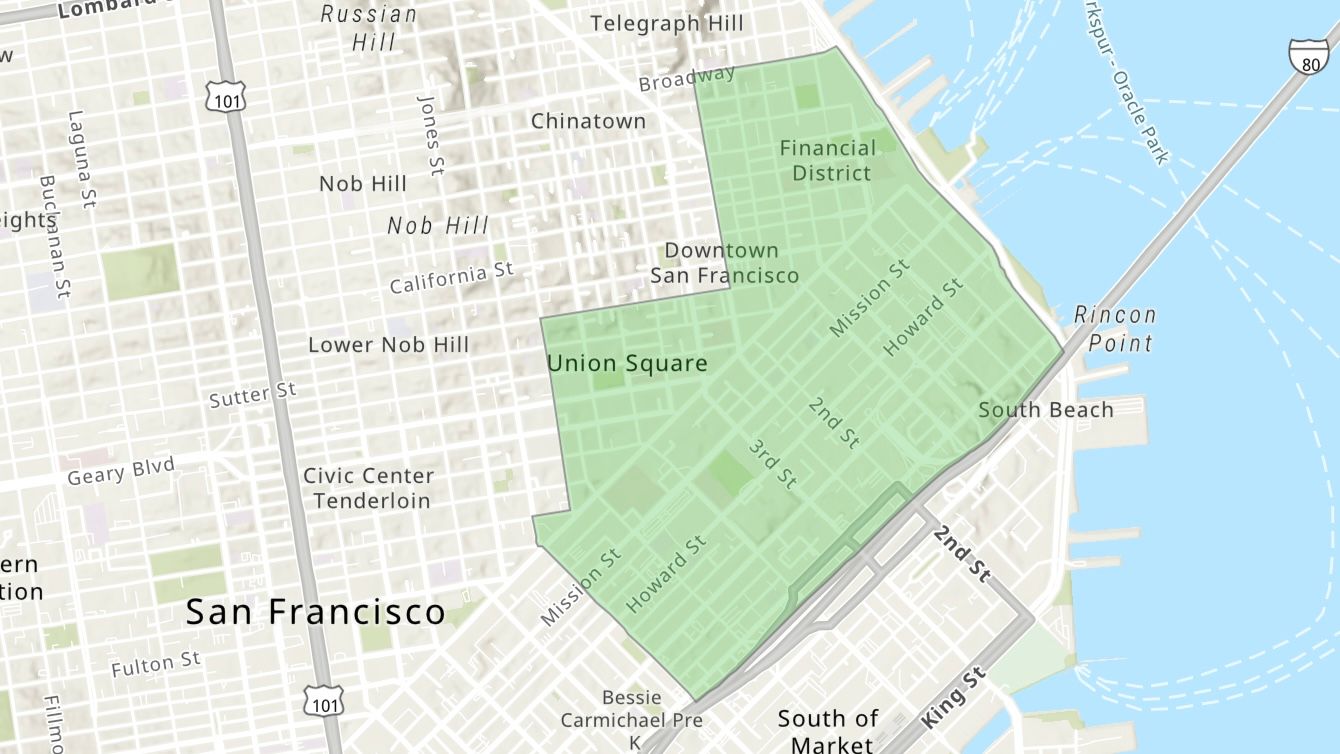

SAN FRANCISCO — San Francisco has announced a new $3.6 million low interest loan and grant program to encourage small businesses to fill the vacant storefronts in downtown which includes Union Square, South of Market (SoMa) and the Financial District. Another similar program will be launched soon for the neighborhoods with large Asian communities.

The newly-announced program, Downtown San Francisco Vibrancy Loan Fund, is one of a series of initiatives introduced by Mayor Daniel Lurie to revitalize San Francisco Downtown and support small businesses for reaching a goal to thrive the entire city.

The new Downtown San Francisco Vibrancy Loan Fund program is managed by the City's Office of Economic and Workforce Development (OEWD) and in partnership with Main Street Launch, a non-profit community development financial institution through innovative collaborations with agencies and corporations to provide capital and technical assistance to small businesses across California.

Under the new program, the city will also increase the match grant amount from $25,000 to $50,000 for every eligible loan of up to $100,000. A business can access up to $150,000 in capital to open a storefront space in San Francisco Downtown, Financial District and SoMa.

The loan component is administered by the Main Street Launch offering 4% interest rate loans with amounts ranging from $25,000 to $100,000 for buildout, equipment, and other startup expenses, according to OEWD.

Three commercial banks, JPMorganChase, U.S. Bank, and Wells Fargo, are in partnership with Main Street Launch to fundraise additional capital for the Downtown San Francisco Vibrancy Loan Fund program.

“Small businesses are key to San Francisco’s recovery, and programs like the Downtown SF Vibrancy Loan Fund are helping them bring new life and energy to our city’s core,” said Mayor Lurie in announcing the new loan and grant program. “Every new storefront represents a business owner taking a chance on San Francisco — creating jobs, activating our streets, and showing confidence in the future of downtown.”

“OEWD prioritizes meeting entrepreneurs where they are by showing up with resources, guidance, and partnership to help them succeed. Every new storefront becomes part of the synergy that’s revitalizing downtown — increasing foot traffic, supporting other small businesses, and energizing our commercial corridors,” said Anne Taupier, Executive Director of OEWD.

There are requirements for business owners to be qualified for the new loan and grant program.

Businesses must be moving or expanding into a ground floor, public-facing vacancy within the designated downtown areas including Union Square, SoMa, and Financial District. They may not be chain or franchise businesses. At least 51% of a business owned by a U.S. citizen or permanent resident.

The loan can be used to cover startup expenses, rent, utilities, furniture, fixtures, equipment and purchase inventory to boost the businesses.

Francis Chan, Senior Program Manager Chinatown of OEWD, confirmed that Chinatown was not included in the newly-announced Downtown San Francisco Vibrancy Loan Fund program which was created to offer a special low-interest loan program to fill many commercial vacancies and foster business activity in three specific neighborhoods within the downtown area of San Francisco.

In order to qualify for the new loan and grant program, the commercial vacancies must be ground floor storefronts without any business operating for at least six months based on valid documents, Chan said.

Chan also revealed that a similar grant program would be launched by the City soon for businesses in the Asian neighborhoods including Chinatown.

Coco Chen and her husband opened a houseware shop, Trending House, on Clement Street in Richmond District in 2022. She welcomed the City’s new program to reduce storefront vacancies in San Francisco Downtown.

However, Chen has not yet benefited from any grants or programs offered by the City although her houseware store was opened to fill a storefront which was vacant for two years during the pandemic. "We wanted to revitalize this neighborhood when we made up our mind to open our store here on Clement Street," said Chen.

"Our business has been so slow during the past three years, also in 2025 under Mayor Lurie," said Chen. "Small businesses are facing multiple challenges. We are struggling to survive. We are not able to hire the employees we need. All these are obstacles to stop us from growing our business."

"Long-term strategies are far more necessary to support small businesses to survive and thrive, like shopping coupons and more incentives to encourage customers to shop and dine in San Francisco," Coco Chen added. "Employment referral services for small businesses and job seekers are also needed and beneficial for both sides."

Wei Huang and her husband have owned a small sandwich shop in San Francisco Chinatown for years and always looked for opportunities to expand their business.

"Our shop in Chinatown is very small with limited space. It is difficult to grow our business to make a profit. We are struggling to survive as well," said Huang. "We are interested in finding a larger storefront to continue our business if the City offers incentives like this [Downtown Vibrancy Loan Fund program]."

____________________________________________________________________________________________

Portia Li is the editor and publisher of Wind Newspaper. Prior to co-founding the Wind Newspaper in 2020, Portia was a senior and investigative reporter at the San Francisco Bureau of World Journal for over three decades. She was born and raised in Hong Kong, educated in Taiwan and the United States. She has a bachelor’s degree in Journalism from National Chengchi University of Taiwan and a master’s degree in Mass Communication from Utah State University. In 2021, Portia was a proud recipient of the Society of Professional Journalists (SPJ) Northern California Chapter’s Career Achievement Award in Print. She can be reached at portia@WindNewspaper.com.

- San Francisco becomes a newest local partner of Dolly Parton’s Imagination Library in the Bay Area to offer free books to all young children

- California state employees alarmed by demand to prove their citizenship or work eligibility

- “No Red Lanes on Ocean Avenue”, Chinese American merchants, residents and community members in San Francisco say

- Open Forum: Strong protest against unilateral street closure decision for SF Chinatown night market without merchant consultation

- Interim Police Chief Paul Yep honored for leadership with historic low crime rate and record high police hirings

- An increase in flu activity seen in SF Bay Area, experts recommend everyone aged 6 months and older to receive the flu vaccine

- SB 1234 is fully in effect in 2026 and requires employers to offer retirement plans to all employees, full-time, part-time & short-term

- Six power outages in Sunset District impact residents and businesses among strings of outages in San Francisco in Dec. 2025