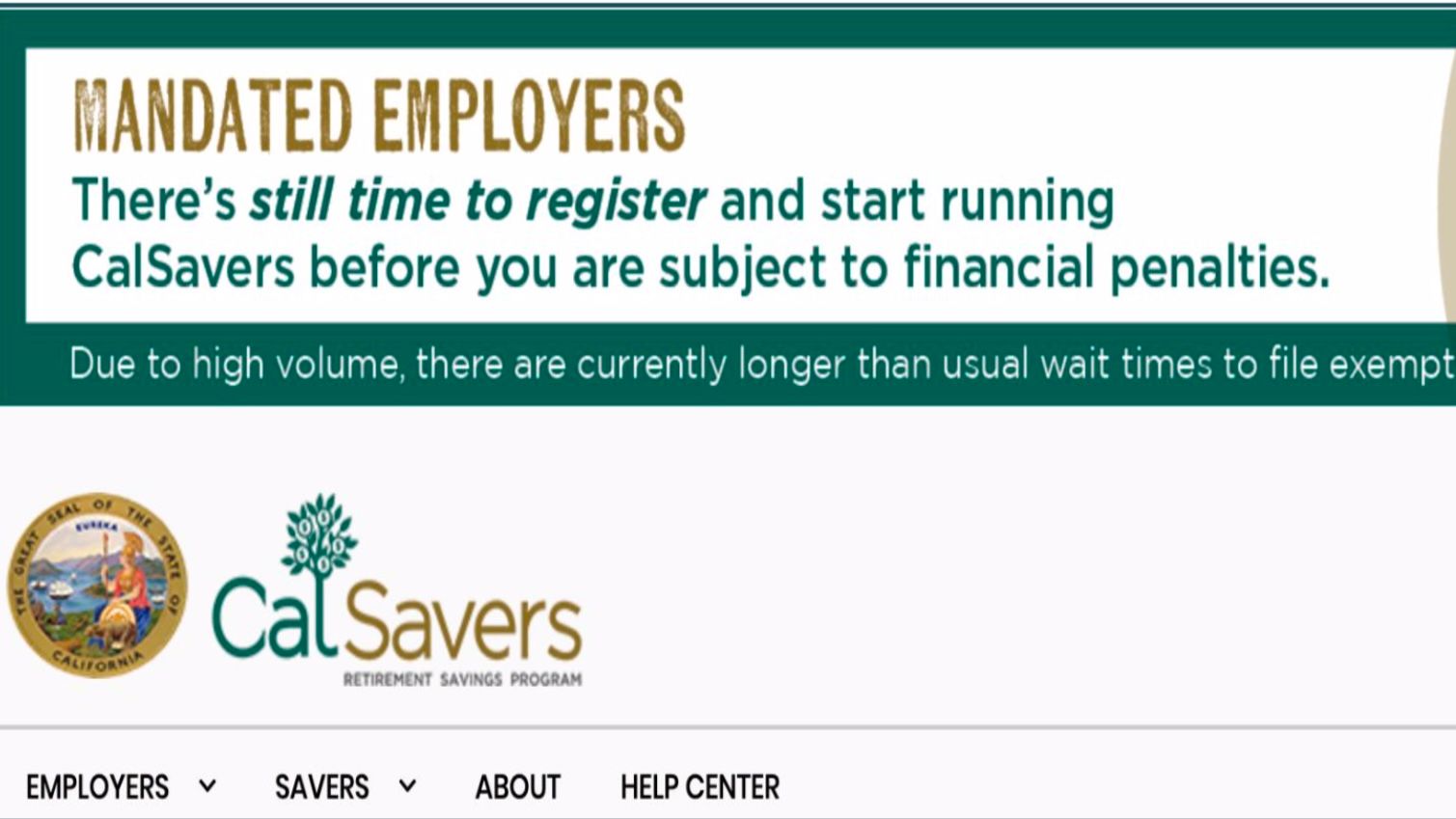

SB 1234 is fully in effect in 2026 and requires employers to offer retirement plans to all employees, full-time, part-time & short-term

SAN FRANCISCO — A bill which was enacted in California in 2016 has become fully in effect on January 1, 2026. Under California Senate Bill 1234, all employers including only one employee are required to offer the state-facilitated retirement savings program, CalSavers, or private retirement plans for all employees in California.

Any employers who have not registered for the CalSavers system (www.calsavers.com) are encouraged to do so as soon as they can. "Mandated employers: There's still time to register and start running CalSavers before you are subject to financial penalties," the CalSavers program noted online.

The CalSavers program is overseen by the CalSavers Retirement Savings Board, which is an agency of the State of California chaired by the California State Treasurer.

There are exemptions if any employer already sponsors a qualified retirement plan like 401(k) or its own pension, or does not hire any employees other than owner(s), or the company's classification is either a government entity, religious organization, or tribal organization.

SB 1234, which was named California Secure Choice Retirement Savings Act and created the CalSavers Retirement Savings Program, was co-authored by then State Senate President Pro Tem Kevin De Leon and former California State Treasurer John Chiang in 2012 and signed by former Governor Jerry Brown into law in 2016.

SB 1234 laid the foundation for the brand new state-sponsored CalSavers retirement savings program for all California workers. The CalSavers Retirement Savings Board adopted final regulations for the program in 2018. Employer registration for the program began in 2020.

The CalSavers program is a state-sponsored retirement savings program for private sector workers whose employers do not already offer a retirement plan. CalSavers is an automatic enrollment individual retirement account (IRA) with no employer fees or fiduciary duties.

Because the CalSavers program is not sponsored by the employer, and therefore the employer is not responsible for the program or liable as a program sponsor.

The program is professionally managed by private sector financial firms and overseen by a public board, CalSavers Retirement Savings Board, chaired by the California State Treasurer.

Under SB 1234 passed in 2016, all California employers with at least five California employees are required to offer their California employees a retirement savings plan, either from the private market or by registering to participate in the new CalSavers program.

All eligible employers must either register for CalSavers or opt-out by the following deadlines:

● September 30, 2020 for employers with over 100 employees;

● June 30, 2021 for employers with over 50 employees;

● June 30, 2022 for employers with 5 or more employees.

Once employers have registered into the CalSavers system, the CalSavers is a completely voluntary retirement program for their employees to participate through their employers or on their own to choose their contribution rates, change their investments, or opt out (and opt back in) at any time.

Employees may also choose to have their accounts set up by the CalSavers program including a payroll-based retirement saving option that allows employees to save a certain portion of their wages into the program for their future while employers facilitate the program without fees or fiduciary liability.

Employees may also participate in the standard account settings, including contributing 5% of pay and investing in a fund chosen based on employees' ages.

SB 1234 made California a leader in state-sponsored retirement programs, providing a vital safety net for workers and serving as a national model for improving retirement security.

It is estimated that SB 1234 has created an auto-enrolled, supplemental retirement savings program for nearly 7 million private sector workers in California who did not previously have access to a retirement savings plan through their job.

The expansion of SB 1234 to cover employers with just one employee occurred later as part of the program's phase-in with full implementation by December 31, 2025. The mandate for compliance includes any California employer with one or more employees and applies to all employees with part-time or short-term workers.

Starting January 2026, all California employers must comply with the law and either enroll in the state-run CalSavers program or offer their own qualified retirement plans, such as 401(k), simple IRA or SEP IRA which is a Simplified Employee Pension Plan for self-employed individuals and small business owners along with employees.

Penalties for noncompliance is $250 per eligible employee for initial noncompliance and $500 per eligible employee for continued noncompliance.

As of December 30, 2025, more than 598,000 California employees have funded retirement accounts through CalSavers, collectively saving more than $1.59 billion, with a median monthly contribution of $146.

At the same time, nearly 247,000 employers have registered, and more than 64,100 employers are actively facilitating payroll contributions, reflecting steady growth since CalSavers launched in 2019.

“Retirement security shouldn’t depend on where you work or how much you earn,” said California State Treasurer Fiona Ma, CPA. “What we’re seeing is hundreds of thousands of Californians consistently setting aside money for their future—often for the first time—simply because saving is built into their paycheck. That’s exactly the kind of access CalSavers was designed to create.”

Ma said the CalSavers program particularly would benefit workers employed by small and midsize businesses, as well as those who are lower-wage, part-time, or working in industries and communities where access to retirement plans has traditionally been limited.

“With the workplace retirement requirement now fully in effect, we’re ensuring that saving for the future is no longer a privilege reserved for a few, but a basic opportunity available to workers across our state,” said CalSavers Executive Director David Teykaerts. “CalSavers is helping people take control of their financial futures, one paycheck at a time.”

"Half of California workers are projected to have serious economic hardship when they retire because they don’t have sufficient savings, and 7 million private sector workers—55%—do not have access to a pension or 401(k) at work," the UC Berkeley Labor Center stated in its report on SB 1234 in 2017. "Low-wage workers, small business employees, and Latinos are also much less likely to have access to a retirement plan. And Social Security, while critical, is not enough for most retirees to make ends meet in California."

In order to address this retirement crisis, California enacted SB 1234 in 2016 authorizing implementation of the California Secure Choice Retirement Savings Program to help millions of workers save for retirement, the UC Berkeley Labor Center further stated.

Are employers likely to drop their existing retirement plans and instead enroll their employees in the CalSavers program?

The CalSavers differs from an employer sponsored retirement plan, whether a pension or 401(k) account, the UC Berkeley Labor Center noted. "In the vast majority of cases where employers already sponsor a plan, CalSavers is unlikely to be an adequate substitute because of low contribution limits and the prohibition on employer contributions."

The CalSavers program may be a better alternative for employers if three conditions are met: the employer plan is small and burdened with high fees; the plan has low participation rates; and employees are unlikely to want to contribute more than $5,500 a year, according to the UC Berkeley Labor Center.

____________________________________________________________________________

Portia Li is the editor and publisher of Wind Newspaper. Prior to co-founding the Wind Newspaper in 2020, Portia was a senior and investigative reporter at the San Francisco Bureau of World Journal for over three decades. She was born and raised in Hong Kong, educated in Taiwan and the United States. She has a bachelor’s degree in Journalism from National Chengchi University of Taiwan and a master’s degree in Mass Communication from Utah State University. In 2021, Portia was a recipient of the Society of Professional Journalists (SPJ) Northern California Chapter’s Career Achievement Award in Print. She can be reached at portia@WindNewspaper.com.

- Alleged scams appear in Chinese-language newspaper job advertisements seeking workers caring for the elderly, San Francisco Police Department urges victims to file reports

- San Francisco becomes a newest local partner of Dolly Parton’s Imagination Library in the Bay Area to offer free books to all young children

- California state employees alarmed by demand to prove their citizenship or work eligibility

- “No Red Lanes on Ocean Avenue”, Chinese American merchants, residents and community members in San Francisco say

- Open Forum: Strong protest against unilateral street closure decision for SF Chinatown night market without merchant consultation

- Interim Police Chief Paul Yep honored for leadership with historic low crime rate and record high police hirings

- An increase in flu activity seen in SF Bay Area, experts recommend everyone aged 6 months and older to receive the flu vaccine

- SB 1234 is fully in effect in 2026 and requires employers to offer retirement plans to all employees, full-time, part-time & short-term