NAPCA Column 9: Two different enrollment periods for Medicare coverage to end on March 31

Question 1: What is the difference between GEP (General Enrollment Period) and MAOEP (Medicare Advantage Open Enrollment Period)?

Answer 1: GEP and MA OEP take place annually during the same time window but are distinct periods related to Medicare, and they serve different purposes.

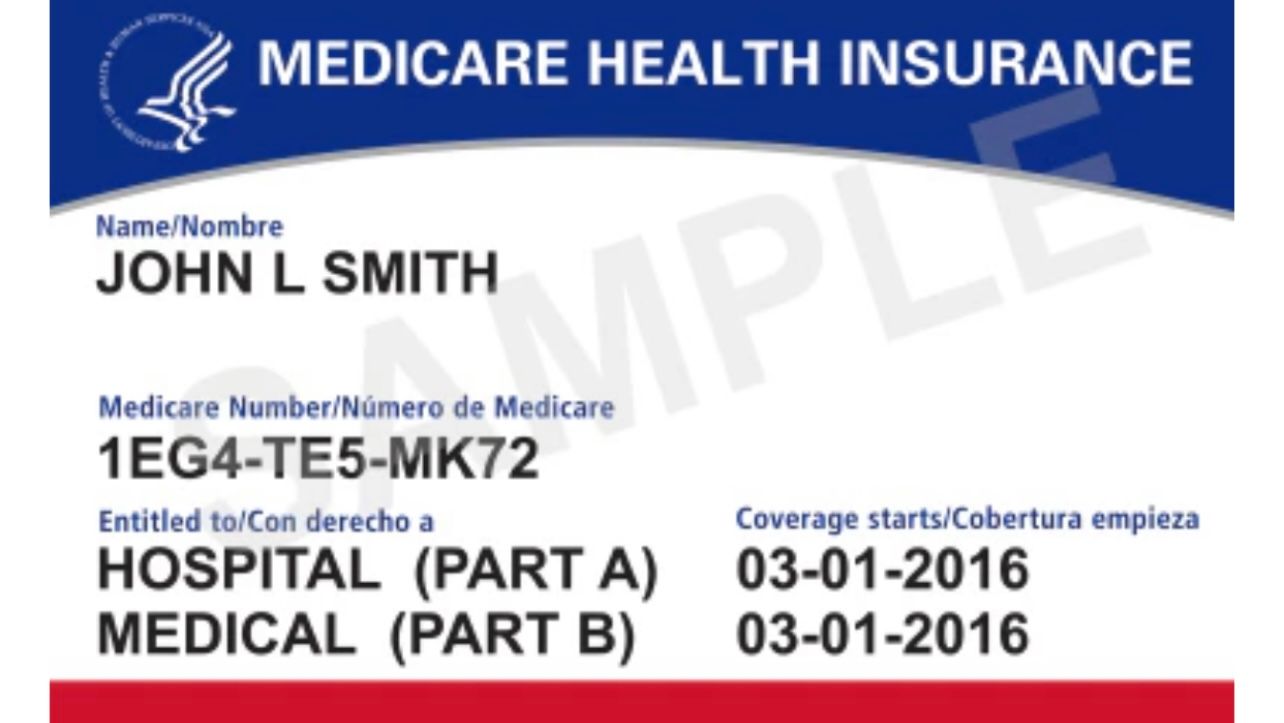

GEP is for individuals who were first eligible for Medicare but didn’t enroll in Medicare Part A and/or Part B during their Initial Enrollment Period (IEP) and who aren’t eligible for a Special Enrollment Period (SEP). For example, if you delayed initial enrollment when you were first eligible for Medicare due to having current job-based health insurance, and later, when you retire or you are no longer covered by your employer insurance, you may be eligible to have 8-month SEP. If you missed the SEP, you should use GEP to enroll in Medicare.

Note that MA OEP is specifically only for individuals who are already enrolled in a Medicare Advantage Plan (Part C, MA plan) and want to make changes.

Question 2: What can I do during GEP (General Enrollment Period)?

Answer 2: During GEP, individuals can enroll in Medicare Part A and/or Part B for the first time. Coverage will begin on the first day of the following month after you enroll, and you may face a late enrollment penalty because you missed your Initial Enrollment Period. The penalty could result in higher premiums for as long as you have Medicare.

Note that you may not sign up for a stand-alone Medicare Part D prescription drug plan during GEP even if you need drug coverage with Original Medicare as drug coverage is not included. The GEP is specifically for enrolling in Medicare Part A and/or Part B, not for Part D. To have a stand-alone Part D plan, you may have to wait for the upcoming Medicare Open Enrollment Period that occurs between October 15 and December 7 every year.

Question 3: What can I do during MA OEP (Medicare Advantage Open Enrollment Period)?

Answer 3: As mentioned in Question 1, MA OEP is only for those who already are enrolled in MA plan. You can switch from one MA plan to another, or you can disenroll from your Medicare Advantage plan and return to Original Medicare (Part A and Part B). If you return to Original Medicare, you have the option to enroll in a stand-alone Medicare Part D prescription drug plan.

Note that MA OEP does not apply to Original Medicare beneficiaries, that means you cannot switch from Original Medicare to MA plan, you cannot join a part D prescription drug plan or cannot switch one part D plan to another if you’re in Original Medicare.

Question 4: Can I add a Medigap plan to Original Medicare during GEP or MA OEP?

Answer 4: Medicare basically covers 80% of the cost for each Medicare-covered service or item after you’ve paid your deductible. If you decide to stay with Original Medicare (Part A and B) and want to cover the 20% financial gap that Medicare doesn’t pay for, you may want to add a Medigap plan to your Original Medicare.

Ideally, the best time to purchase a Medigap policy is during your Medigap OEP, which starts the first day of the month that you are both 65 or older AND enrolled in Medicare Part B. This period lasts for six months. During this period, Medigap companies must sell you a policy at the best available rate regardless of your health status, and they cannot deny you coverage.

If you miss your Medigap Open Enrollment Period, you can still apply for a Medigap policy, but you may face underwriting which insurers use to figure out your health status and determine whether to offer you coverage, at what price, and with what exclusions or limits. Based on your pre-existing health conditions, you may have to have a waiting period or insurers may charge you more or deny coverage based on pre-existing conditions.

Be aware that this information only pertains to protections that apply nationwide. Some states have other protections that give their residents additional opportunities to enroll in a Medigap.

*National Asian Pacific Center on Aging (NAPCA) is a non-profit organization dedicated to improving the quality of life of AANHPI older adults and their families. It operates a NAPCA Senior Assistance Center for Older Adults and Caregivers and is available in 5 different languages.

NAPCA’s Note:

Two different enrollment periods for Medicare coverage will end on March 31, which are GEP (General Enrollment Period) and MA OEP (Medicare Advantage Open Enrollment Period). Please contact us to receive assistance with enrollment.

If you have additional questions about Medicare, Medicaid, Affordable Care Act Health Insurance Marketplace, Social Security Retirement Benefit, Supplemental Security Income, or COVID/Flu vaccination, there are 3 ways you can reach us today:

Call (English) 1-800-336-2722,

(Chinese Mandarin) 1-800-683-7427,

(Chinese Cantonese) 1-800-582-4218,

(Korean) 1-800-582-4259,

(Vietnamese) 1-800-582-4336

Email: askNAPCA@napca.org

Mail: NAPCA Senior Assistance Center, 1511 3rd Avenue, Suite 914, Seattle, WA 98101

- “No Red Lanes on Ocean Avenue”, Chinese American merchants, residents and community members in San Francisco say

- Open Forum: Strong protest against unilateral street closure decision for SF Chinatown night market without merchant consultation

- Interim Police Chief Paul Yep honored for leadership with historic low crime rate and record high police hirings

- An increase in flu activity seen in SF Bay Area, experts recommend everyone aged 6 months and older to receive the flu vaccine

- SB 1234 is fully in effect in 2026 and requires employers to offer retirement plans to all employees, full-time, part-time & short-term

- Six power outages in Sunset District impact residents and businesses among strings of outages in San Francisco in Dec. 2025

- California bans all plastic carryout bags at retail stores starting January 1, 2026, only allows recycled paper bags to be distributed to customers

- If someone’s vehicle blocks your driveway, San Francisco's 311 service will resolve it easier and safer for you